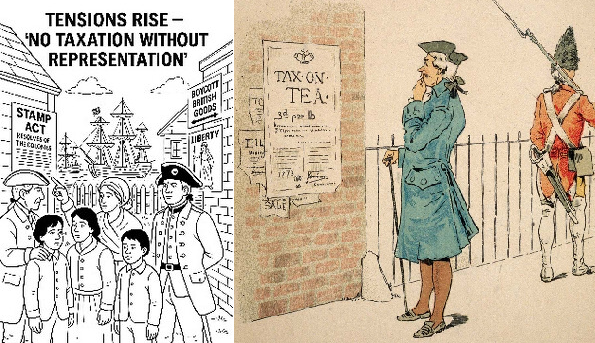

In the 1760s, Samuel Adams published the phrase “No Taxation without Representation” in the Boston newspapers. This slogan drove protests against the Stamp Act of England, which resulted in the famous Tea Party revolt that helped to trigger the American Revolution.

During his 1861, 4.5-hour speech addressing the “Writ of Assistance, where Britain was asserting its will to issue search warrants in the states, James Otis equated taxation without Representation to tyranny. This is where the famous phrase “No taxation without representation” came from.

During the administration of Woodrow Wilson, the 16th and 17th amendments were added to the US Constitution.

The 16th Amendment created the income tax – a tax that bypassed the states and got our Federal government directly into our back pockets.

The 17th Amendment changed the election of the US Senators from appointment by state legislatures to direct popular election.

The bicameral Congress originally represented the states in the Senate and the people in the House, but now only represents the popular sentiment.

Interestingly, all the state senates are and mostly have been elected popularly, which makes having a state bicameral house structure redundant and somewhat deceptive.

These two acts alone allowed the federal government to exert far more control over the states and severely eroded their sovereignty and rights.

Following these changes and the creation of the Federal Reserve Act, we saw our government under FDR create the 4th branch of government and steal our gold.

A slew of acronym agencies have since effectively “eaten out our substance” (Declaration of Independence) with regulations that bypassed our direct representation via Congress, as the bureaucrats were not elected but appointed by the executive branch.

Now we see things like laws being passed that:

Note that things are not working the way the founders designed it. It seems extremely odd that the US Senate, while being appointed by its respective state legislatures, would vote to pass amendments that diminish state rights so significantly.

To me, this points to massive corruption even back in 1913.

It is also interesting that state senates have rarely represented the counties, but are directly elected instead.

Yet they all have bicameral legislatures except Nebraska, which was created for simplicity reasons back in 1937.

Incidentally, Nebraska is also the only legislature that doesn’t have a two-party seating arrangement.

One idea that comes to mind is for states to force all income taxes to go to the state first, for holding and passing the funds onto the federal government in one annual payment.

This accomplishes a bunch of good things:

It is doubtful that the federal government, with its usurped power, would allow this to happen, but it would force the gloves to come off of this tyrannical mess we have allowed ourselves to fall into.

The states would finally realize they are now nothing but sub-corporations of a federal empire.